For many families living in poverty, saving money can seem like an impossible task. With limited income and high expenses, it can be challenging to find ways to save for the future. However, there are ways to save money even when you are living on a tight budget. In this blog post, we will discuss some tips and strategies to help poor families save money and improve their financial situation.

- Set a Budget

The first step in saving money is to create a budget. A budget is a plan that outlines your income and expenses, and it helps you identify areas where you can cut back on spending. Start by listing all your sources of income and then list all your expenses, including rent, utilities, food, transportation, and any other bills or payments you make regularly. Once you have a clear understanding of your expenses, you can look for ways to reduce them and find areas where you can save money.

- Cut Back on Expenses

Once you have a budget, it's time to look for ways to reduce your expenses. Start by looking at your largest expenses, such as housing and transportation. Can you find a cheaper place to live or switch to public transportation instead of driving? You can also save money on food by cooking at home and buying in bulk.

- Save on Utilities

Utility bills can be a significant expense for poor families, but there are ways to reduce these costs. Start by turning off lights and appliances when they are not in use. You can also install low-flow showerheads and faucet aerators to reduce your water usage. In addition, consider weatherizing your home to reduce heating and cooling costs.

- Shop Smart

When shopping, always look for sales and discounts. You can also save money by buying generic or store-brand products instead of name-brand items. Shopping at discount stores and using coupons can also help you save money on groceries and household items.

- Avoid Debt

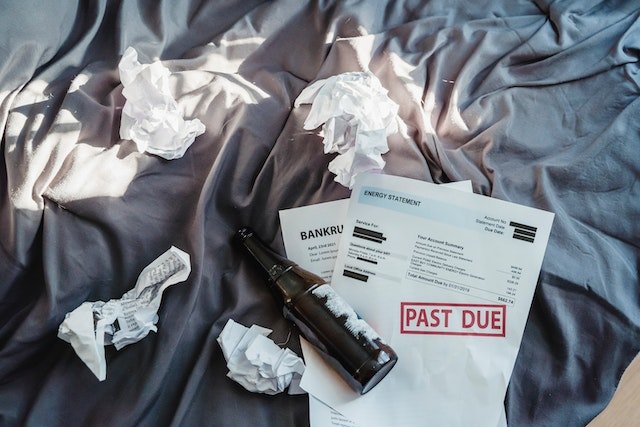

One of the most significant challenges for poor families is debt. Avoid taking on new debt, and focus on paying off any existing debt as quickly as possible. This will help you save money on interest and fees and improve your overall financial situation.

- Build an Emergency Fund

Building an emergency fund is crucial for poor families. An emergency fund is money set aside for unexpected expenses, such as medical bills or car repairs. Start by setting aside a small amount of money each month, and gradually build your emergency fund over time.

- Use Community Resources

There are many community resources available to help poor families save money. Food banks and community kitchens can provide free or low-cost meals, while clothing banks and thrift stores can provide affordable clothing and household items. In addition, many community organizations offer financial counseling and other services to help families manage their money.

In conclusion, saving money can be a challenge for poor families, but it's not impossible. By setting a budget, cutting back on expenses, shopping smart, avoiding debt, building an emergency fund, and using community resources, families can improve their financial situation and create a better future for themselves and their children.